38+ Mortgage interest deduction calculator

For example a borrower who has a 150000 mortgage amortized over 25 years at an interest rate of 545 can pay it off 25 years sooner by paying an extra 50 a month over the life of the mortgage. Follow the mentioned steps to calculate mortgage interest deduction limit.

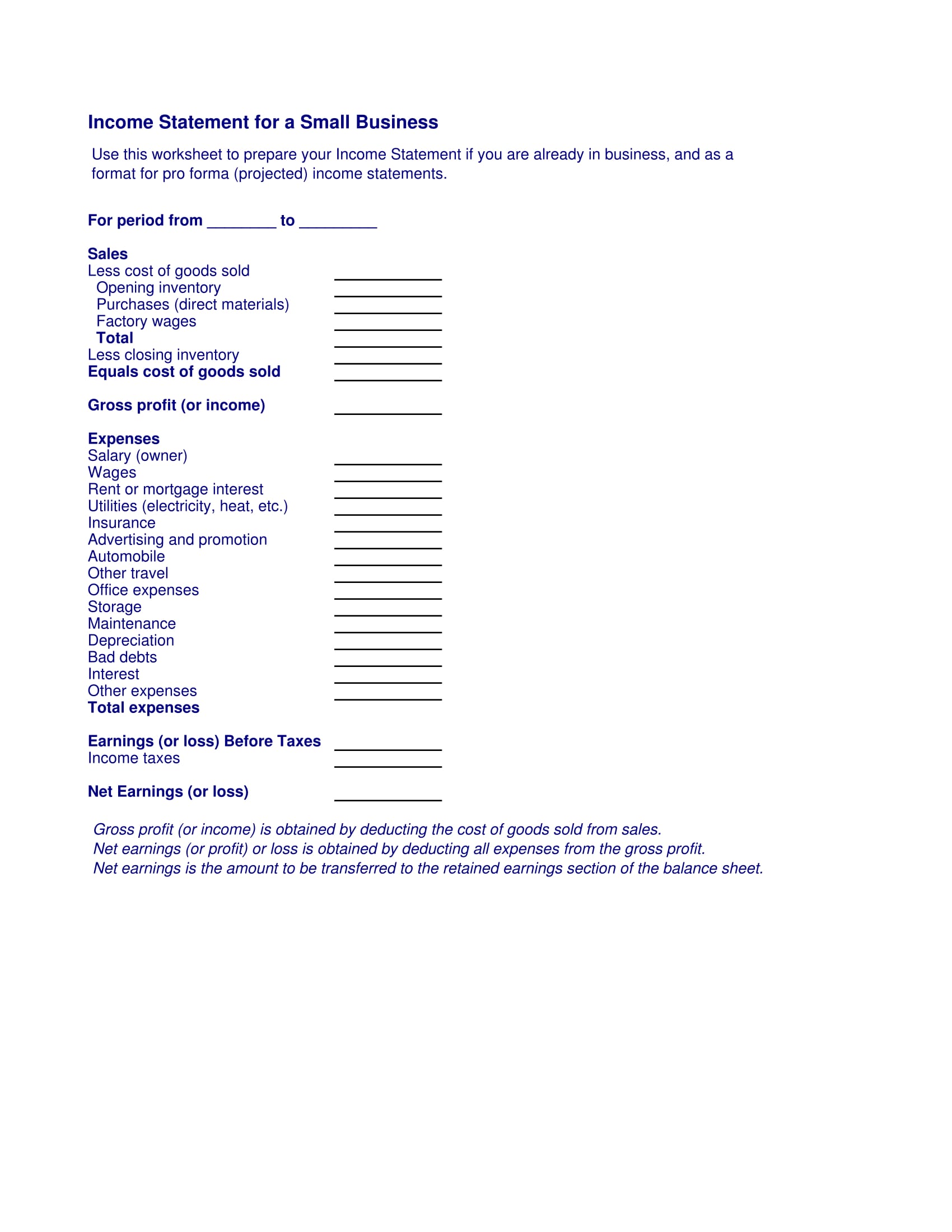

Understand Your Financials Fedex Small Business Center

For heads of households it is 18800 in 2021 increasing.

. Multiply the result by the interest paid to calculate your deduction. Your tax savings will be 187 for a home equity loan and 372 for a HELOC. Use this calculator to see how much you could save.

Please note that if your mortgage closed on or after December 15th 2017 the mortgage tax deduction is. Since the limit is 750000 divide 750000 by 150 million. This may be just what you need to push you over and have you purchasing a home because of this benefit.

The government has taken several measures to support. For taxpayers who are single or married but filing separately the standard deduction is 12550 in 2021 increasing to 12950 in 2022. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. One way to pay off a mortgage faster is to make small additional payments each month. The tentative new Republican party tax plan for 2018 intends to reduce the home mortgage interest deduction from 1000000 in mortgage debt to 500000 in mortgage debt while also signficantly increasing the standard deduction to 12000 for individuals and 24000 for couples.

This is the total amount of the loan that you borrowed in order to purchase your home. Yes - you can deduct the interest paid for each tax year. Mortgage Interest Deduction What You Need To Know For Filing In 2022 A home equity line of credit HELOC and a home equity loan both free up cash by accessing the equity you have in your home.

Mortgage Tax Deduction Calculator Definitions Total Home Loan Amount. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more likely to exceed the value of the standard deduction.

For example if your mortgage is 150 million. People with pre-existing mortgage debt will have the old. They want to know the qualified loan limit and how much of the interest paid is deductible home mortgage interest.

Divide the maximum debt limit by your mortgage balance. This technique can save borrowers a considerable amount of money. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017.

Disclosures Show All This content is intended to provide general information and shouldnt be considered legal tax or financial advice. You will get 05. X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured.

Take note that this doesnt include the down payment. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on your primary home and a second home. Your clients want to buy a house with a mortgage of 1200000.

13 For instance a homeowner that just secured a 200000 mortgage at a 5 percent interest rate would receive roughly 10000 in interest deductions. Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. So the total Interest that is 1000000 5 50000 will be deducted from the total personal income Personal Income Personal income refers to the total earnings of the individuals and households of a nation through multiple sources such as salary wages business profits bonus investment.

If you purchased a 200000 home and made a 20 down payment of 40000 your total home loan amount will be 160000. Take the time to use a mortgage calculator to find out just how much money your mortgage interest payments can provide to you in terms of a tax deduction. Mortgage Tax Deduction Calculator The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible.

The mortgage interest deduction. This allows you to deduct the interest on the mortgage you paid for buying a home building or improving the main home or second home. If you own a home you may not be aware of the tax benefits.

This calculator computes your clients qualified mortgage loan limit and the deductible home mortgage interest.

How Much Home Can I Afford Mortgage Affordability Calculator Mortgage Payment Calculator Mortgage Free Mortgage Calculator

Self Employed Tax Calculator Business Tax Self Employment Employment

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator

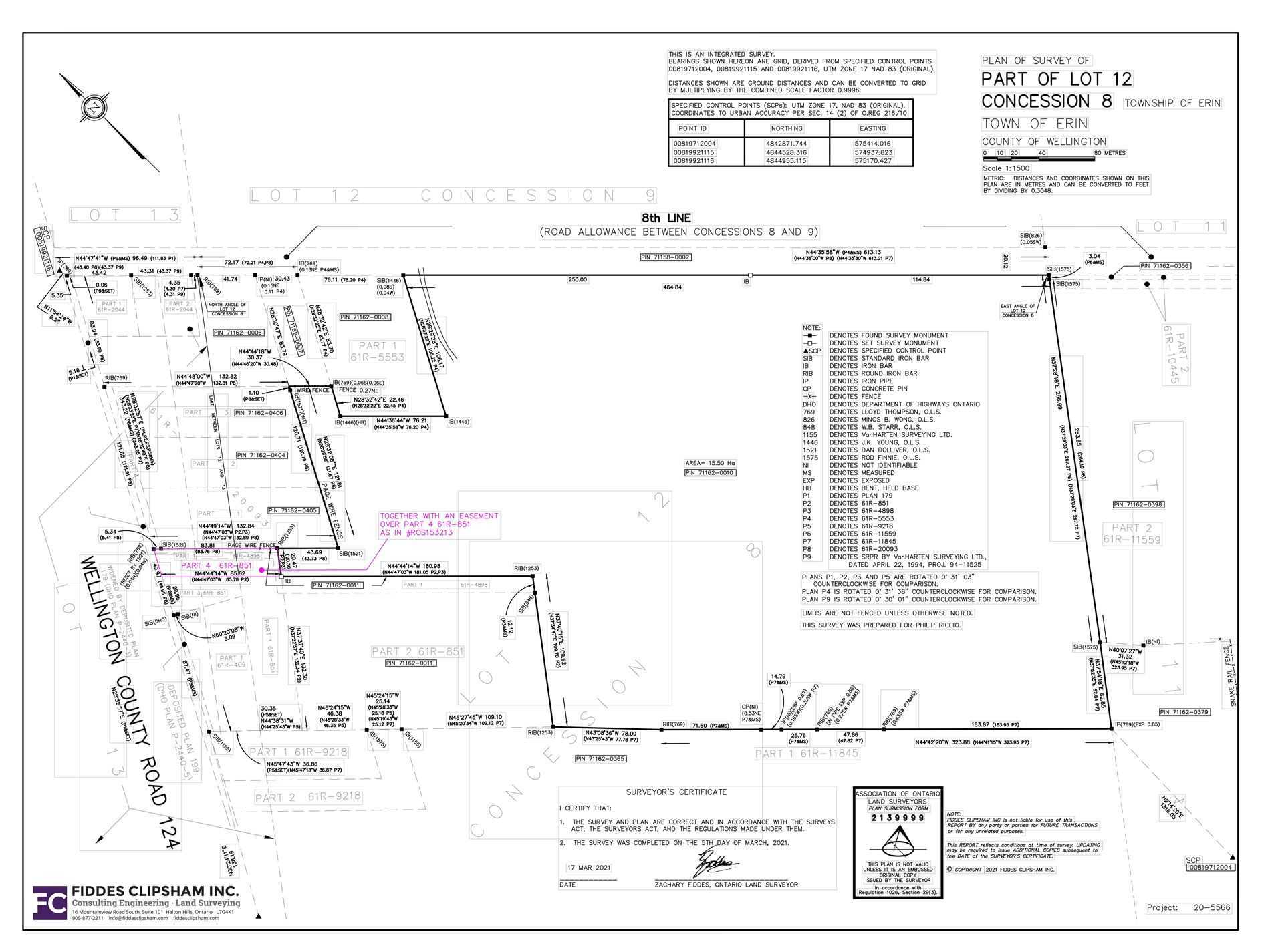

5356 Eighth Line Erin On Land Lot For Sale Rew

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Free 9 Loan Spreadsheet Samples And Templates In Excel

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

Free 9 Loan Spreadsheet Samples And Templates In Excel

Lending Vocab Cheat Sheet Conifer Realty Group Home Mortgage First Time Home Buyers Mortgage Tips

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Free 30 Income Statement Forms In Pdf Ms Word

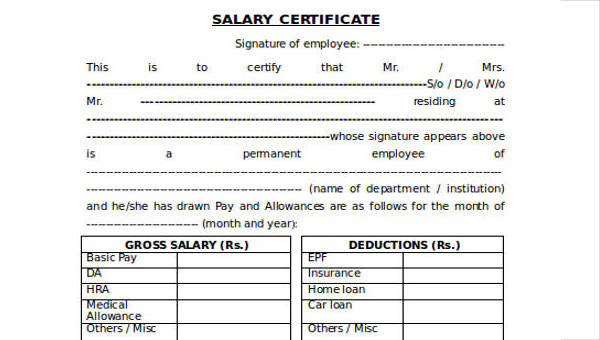

Free 38 Certificate Forms In Ms Word

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Income Tax

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes