401k company match calculator

Thats why our 401 k Growth Calculator allows you to enter a figure anywhere between negative 12 and positive 12. For some investors this could prove.

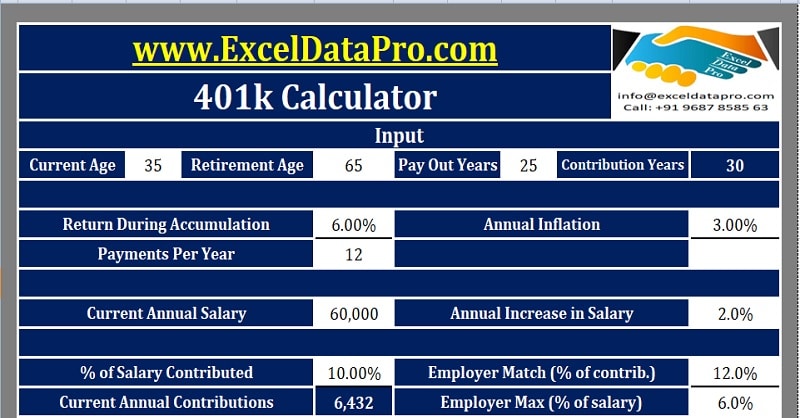

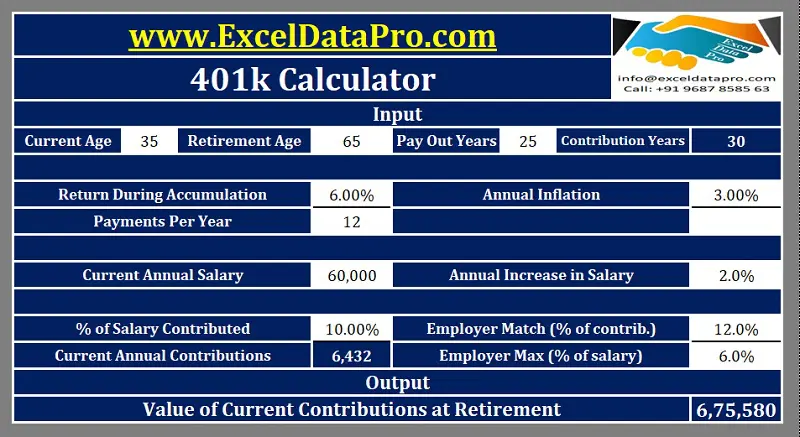

Download 401k Calculator Excel Template Exceldatapro

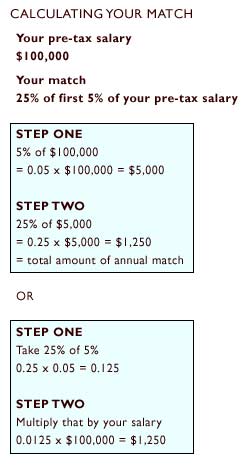

Employer Match This is how much your employer will match your contributions.

. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. It provides you with two important advantages.

Our Financial Advisors Offer a Wealth of Knowledge. If you only contribute 3 your contribution will be 3000 and your employers 50 match will be 1500 for a total of 4500. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000.

It is mainly intended for use by US. If you earn 60000 your contributions equal to 6 of your salary. Protect Yourself From Inflation.

10 Best Companies to Rollover Your 401K into a Gold IRA. Assume that your employer matches 50 of your contributions equal to up to 6 of your annual salary. Make a Thoughtful Decision For Your Retirement.

As you can see your first month you would have 375 9 total match50000 salary12 months 375. A percentage of the employees own contribution and a. If your benefits see.

Traditional or Rollover Your 401k Today. Evaluate how much your employer will contribute. Ad Discover Investment Options that Align with Your Goals.

You want to save for retirement and take advantage of your employers match in your 401 k plan but you arent sure you can afford to. Ad Open an IRA Explore Roth vs. Contact a Financial Advisor.

That extra 6000 basically makes the calculation a no-brainer. Lets go back to the 401k calculator. A 401 k can be one of your best tools for creating a secure retirement.

The most common formulas for 401 matching contributions are. Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution. Searching for Financial Security.

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. For example if you pay 250 and. If you increase your contribution to 10 you will contribute.

Employer match This figure is the percentage of. Some 401k match agreements match your contributions 100 while others match a different amount such as 50. Step 6 Determine whether an employer is contributing to match the individuals contributionThat.

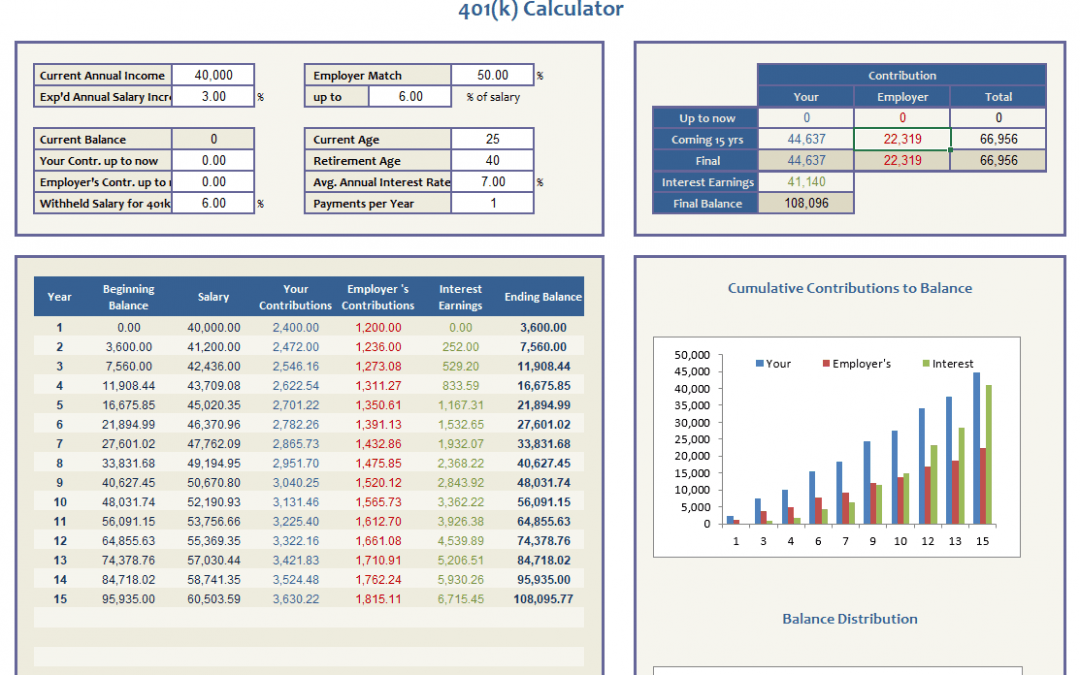

Mark this as the percentage that your employer will match what you pay in. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and. Step 5 Determine whether the contributions are made at the start or the end of the period.

100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. First all contributions and earnings to your 401 k are tax deferred.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

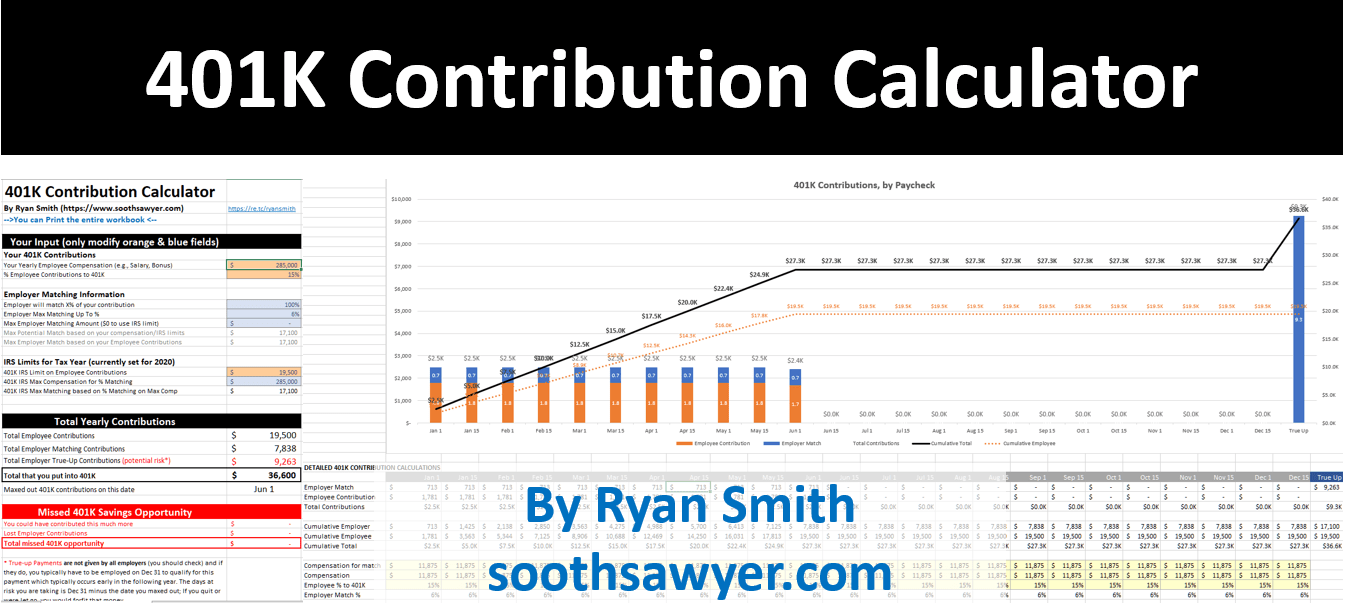

Even without matching the 401k can still make financial sense because of its tax benefits. Month two you are adding another 375 plus youre earning 67. 401 k Contribution Calculator.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. 401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will resu See more. There are literally hundreds of matching formulas out there so contact your 401 plan administrator regarding the rules and specifics of the matching formula used by your.

The annual elective deferral limit for a 401k plan in 2022 is 20500. The employer match helps you accelerate your retirement contributions.

Download 401k Calculator Excel Template Exceldatapro

Doing The Math On Your 401 K Match Sep 29 2000

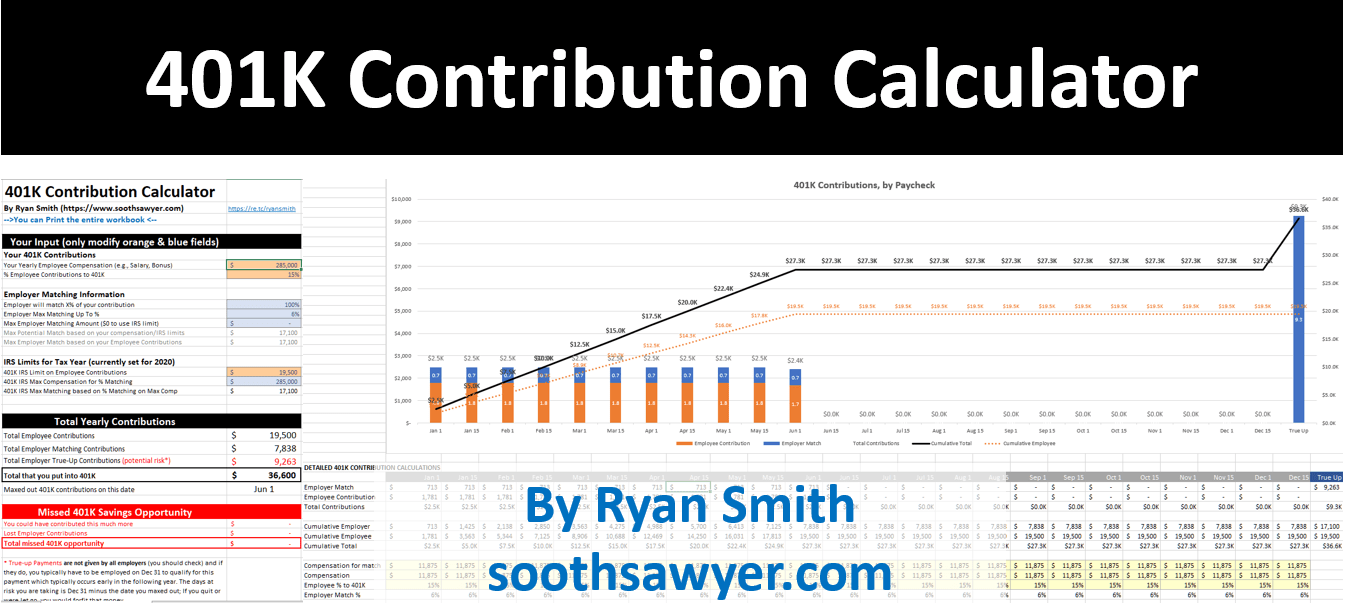

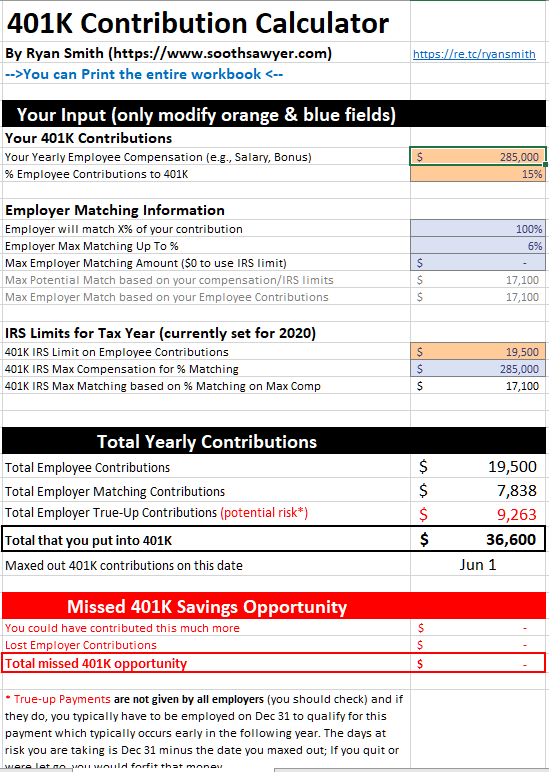

401k Employee Contribution Calculator Soothsawyer

401 K Calculator See What You Ll Have Saved Dqydj

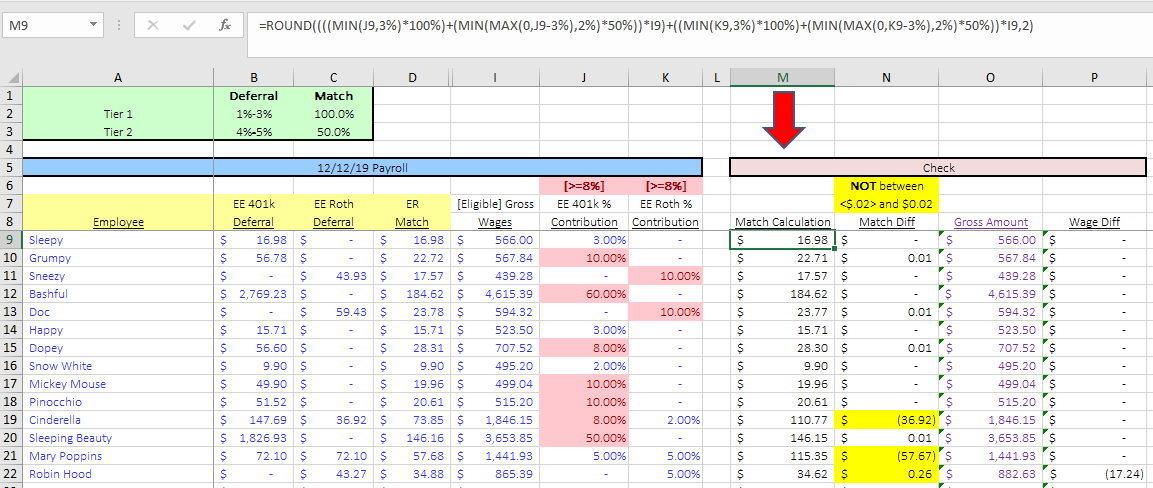

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

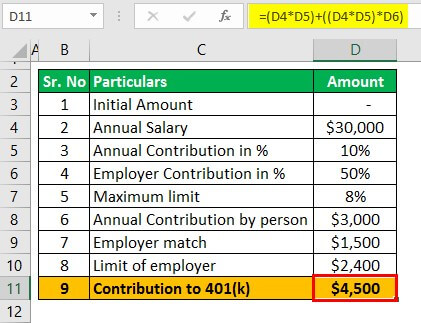

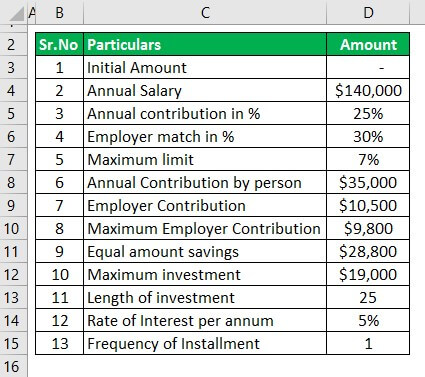

401k Contribution Calculator Step By Step Guide With Examples

401 K Plan What Is A 401 K And How Does It Work

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

Retirement Services 401 K Calculator

401k Employee Contribution Calculator Soothsawyer

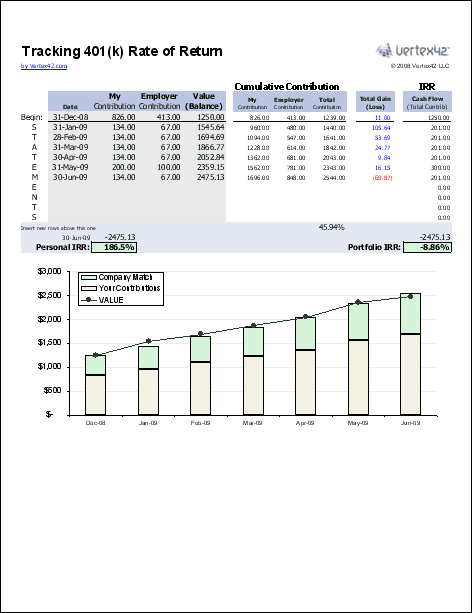

Free 401k Calculator For Excel Calculate Your 401k Savings

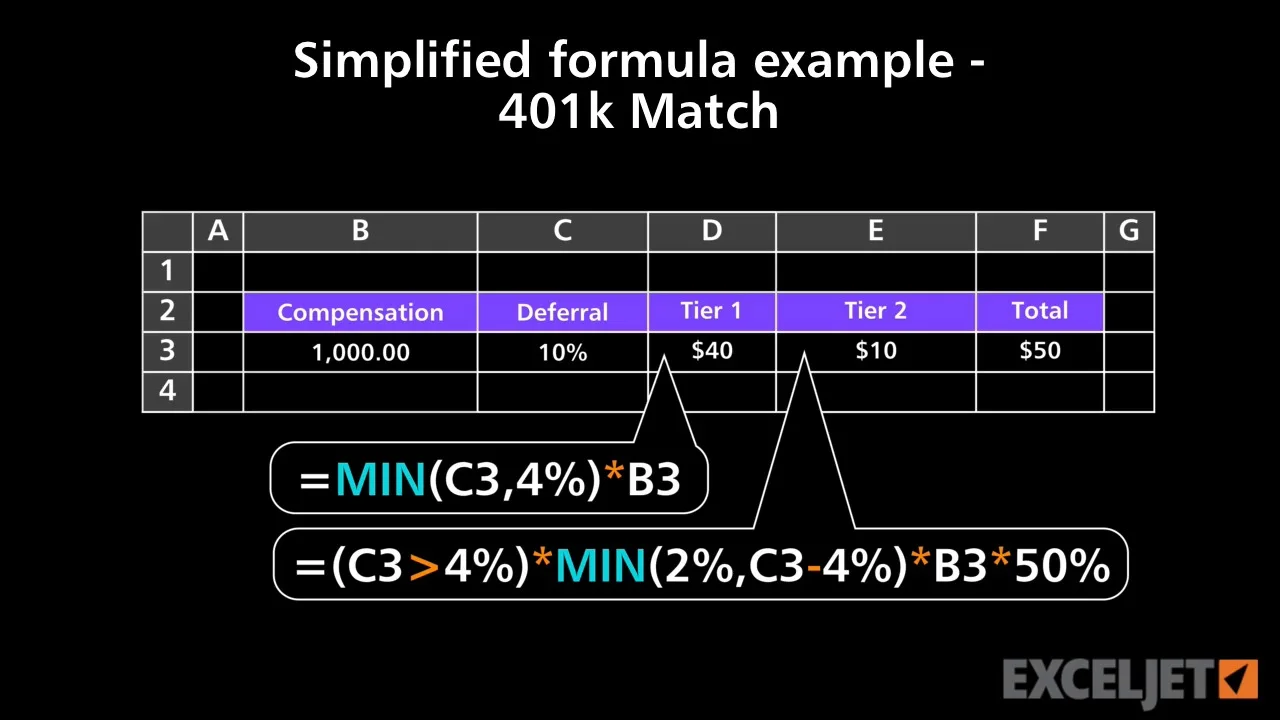

Excel Tutorial Simplified Formula Example 401k Match

401k Contribution Calculator Step By Step Guide With Examples

Excel 401 K Value Estimation Youtube

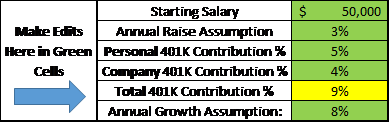

Customizable 401k Calculator And Retirement Analysis Template

Free 401k Calculator For Excel Calculate Your 401k Savings

What Is A 401 K Match Onplane Financial Advisors